Planning for financial year-end

Financial year-end is a critical time for both businesses and individuals and involves summarising and closing financial accounts to prepare for tax obligations, evaluate performance, and plan. Here are some important deadlines you need to know for your financial year end –

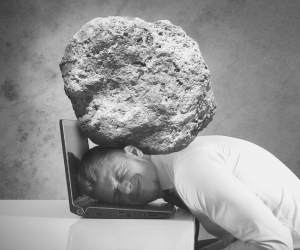

Financial wellness: beyond the numbers

Studies reveal a compelling link between financial stability and mental well-being. Financial stress can spark psychological distress, anxiety, and depression, affecting productivity and employee morale.

Do you know what your debt costs you?

For business owners, debt can be a double-edged sword. On one hand, it provides much-needed capital to expand, invest, or smooth out cash flow gaps but, on the other, it comes at a cost (much of which isn’t immediately apparent).

Financial Literacy for Business Owners

Financial literacy is a critical skill for business owners. It’s not just about understanding numbers, it’s about the ability to make informed financial decisions that can drive the success and sustainability of your business. Here are the five key components of financial literacy that you need to master.

Why marketing is your lifeline in a recession

In our ever-evolving business landscape recessions are inevitable. And, while it’s natural for business owners to want to tighten their belts during economic downturns, history shows that it’s the perfect time to invest in marketing.

10 Reasons why you need a CA for your business

Whether you employ five or 200 employees, businesses of this size are commonly regarded as the backbone of our economy, driving innovation, and creating jobs. However, as the owner of a business of this size, the chances are you’re wearing many hats.

Trustees: your new role as a third-party data provider to SARS

Are you a trustee of a resident trust in South Africa? Brace yourself for significant changes as SARS now demands that trustees become third-party data providers. In this blog, we’ll dive into the increased reporting requirements, explore potential challenges, and offer expert advice on navigating this new landscape to ensure compliance and transparency.

Reporting obligation for trusts: do you understand beneficial ownership and compliance?

Since April 2023, trustees have had a new responsibility under the amended Trust Property Control Act, Act 57 of 1998 (TPCA) to report and maintain accurate records of the beneficial ownership of their trusts. Why has this amendment been made?

Mastering the balance: 5 tips for business stress management

Running a business can be overwhelming, but don’t let stress hinder your success. Our latest blog reveals five practical strategies to manage stress and achieve a healthy work-life balance. Prioritise yourself, delegate tasks, set boundaries, connect with peers, and practice stress reduction techniques. Boost your well-being and watch your business performance increase.

Essential practices for mastering your business’s financial management

Financial management is the backbone of a thriving business. Discover the key practices to make informed decisions, optimise revenue, and ensure long-term stability. From strategic financial planning to effective cost management and revenue stream optimisation, this blog post unveils the secrets to financial mastery. Learn how to control costs, manage cash flow, analyse profit margins, make smart investments, and leverage professional advice. Take charge of your business’s financial future today and achieve your goals.